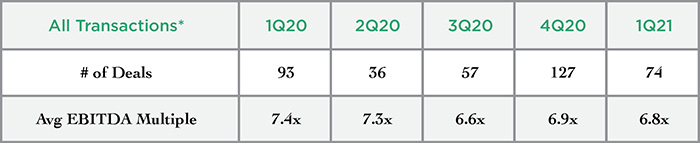

At first glimpse, the 74 M&A deals closed during first quarter 2021 send a confusing message following the record deal level of 127 transactions in fourth quarter 2020, and lower than the first quarter 2020.

SOURCE: GF DATA REPORT – May 2021. GF Data provides data on private equity sponsored M&A transactions with enterprise values of $10 to 250 million. GF Data gives private equity firms and other users more reliable external information to use in valuing and assessing M&A transactions.

Several observations worth noting are:

QUALITY MATTERS. Businesses with above average EBITDA margins and sales growth remain in high demand with professional buyers, resulting in a 34% pricing premium compared to the historical average of 14%. For businesses with these performance attributes that weathered the COVID downturn with little or no impact, deal multiples averaged 7.6X compared to “other” deals averaging 5.7X.

RISK-SHARING DEAL STRUCTURE. For the sellers whose businesses saw a dip in performance during the pandemic and are showing signs of returning to historical performance levels, buyers are pricing deals with risk-sharing components of either seller financing, earnout or equity rollover structures. These components of deal structures should continue as business performance recovers.

MORE ADD-ON DEALS. “Add-ons” remained at 30% of all M&A transactions (i.e., platforms and add-ons) during 1Q 2021 compared to 21% of reported deals in 2018, 27% in 2019 and 30% in 2020. Many professional investors are now deploying their COVID-related cash buildup into add-on transactions to current platform investments.

MOTIVATED SELLERS. With the general perception that federal taxes will increase in 2022, we expect more sellers willing to negotiate deals using various transaction structures in order to close transactions during the remainder of 2021.

INDUSTRY DEAL PRICING. Manufacturing, retail and technology deals benefited with an uptick in EBITDA multiples in 1Q 2021 compared to 2020. Business services, health care and distribution saw some decline in EBITDA multiples versus 2020. While worth noting, we pay more attention to annual deal results as more indicative of market pricing.

LOOKING FORWARD. We view 1Q 2021 as a period of digestion by professional investors to close and assimilate the record deal activity originated in late 2020. Private equity fund raising and business development activities seeking new platforms and add-ons remain robust. Deal pricing remains stable.